Enhance Your Tax Processes with Tailored Solutions

Our prime focus is on providing transformative solutions tailored to your unique business requirements, whether in documentation, tax process automation, or vendor/product selection. We pride ourselves on streamlining tax processes by offering centralized data collection and reporting through innovative platforms. Our expertise extends to a wide range of services, covering everything from business requirements documentation to automation design, support and beyond.

Our Services

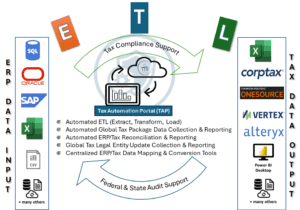

In addition to streamlining individual spreadsheet processes, we also offer a powerful solution that is based on a centralized tax data warehouse called TAP (Tax Automation Portal). TAP is a secure cloud-based SaaS (Software as a Service) data collection, transformation, and reporting platform that can be used to store our clients' sensitive financial data. The TAP portal comes with Admin menus that allows it to be controlled and operated by our clients or by our own TTS staff.

Our cloud-based solutions are hosted by Microsoft on a highly secure and redundant Azure platform that is also used by the fortune 100 corporations. Clients who take advantage of TAP can benefit from automated data imports, data cleansing and automated data transformation (ETL). The transformed and reconciled TAP data immediately becomes available to our clients' tax applications and automated tools like Corptax, OneSource, Alteryx, Excel Power Query, Power BI, etc...

Because TAP prepares the financial data for import to any tax application like Corptax, OneSource, Vertex, etc..., TAP can also be used to reverse-map the tax data back to its financial system sources such as the GL or the sub-ledger. This feature can significantly reduce the time needed to answer State notices and Federal audits.

In summary, we design our solutions to streamline a Tax Department’s big and small recurring processes:

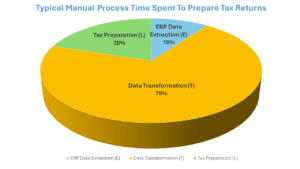

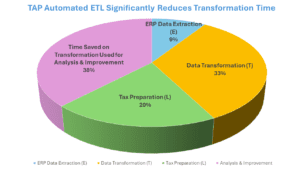

- Our proven technology will significantly reduce the transformation phase of your ETL (Extract, Transform, Load) process.

- Centralized data storage provides access to the same data at different levels of details for different needs. For example, the trial balance that is prepared for the compliance process can also be summarized to produce Executive Dashboards and trending reports. If you are using tools like Power BI or Tableau you will love this feature of our platform.

- Because automation reduces your data cleansing and transformation window, your preparers will now have time for better analysis and planning.

- But most importantly, our Tax Technology team will always be with you whenever you need help with anything that we develop or any other tax application that you use.

At Tax Technology Solutions, we are proud of years of design and implementation of outstanding automation solutions. At our core, we are IT automation experts who also have tax Compliance and Provision experience. We take pride in our approach of developing sophisticated but simple to use products at very affordable cost. While we believe in the power of Alteryx, we have proven Excel-based automated solutions that are as powerful as Alteryx without committing to thousands of dollars in annual cost.

Hyperion SmartView/Corptax Office

If you use other MS Excel add-ins such as Hyperion Retrieve (SmartView) or Corptax Office, the possibilities of streamlining your tax ETL (Extract, Transform, Load) are endless.

ODBC Connectivity

If you have access to financial databases, we can show you how to take your automated processes to the next level without spending money on expensive new tools.

One of the services that we have extensive experience with is the general tax department operations support. Tax Technology Solutions can be engaged to offer part-time or full-time on-demand IT support for a low fixed monthly rate. This service allows our clients to benefit from our extensive experience on a fixed budget and at a fraction of the cost of having their own dedicated Tax Technology team.

At Tax Technology Solutions, we believe understanding of the problem is 50% of the solution. Before we offer a solution, we take the time to understand and document the problem. Normally, requirements documentation can be very detailed and time-consuming. Fortunately, most Tax Technology projects do not need volumes of documentation and therefore, can be documented in relatively short period of time.

After engaging our team, you can expect a Statement Of Work (SOW) that will describe your process improvement needs as well as the cost and timeline of when the new process will be implemented.

Tax Technology Solutions' associates have many years of fortune 100 experience with product and vendor selection. Take advantage of our experience and let us help you with your next market research or product selection. Acquiring the right solution to solve your specific needs can be a complex and time-consuming task. We find it painful to see some tax departments spend hundreds of thousands of dollars on the wrong products that they later alter to meet their needs.

Having the right partner, like Tax Technology Solutions, will ensure the solution that you choose will be the most effective for the job and your budget. It is also worth noting, sometimes the right tool may already be in your toolbox. Before you commit to thousands of dollars on the latest tool du jour, let Tax Technology Solutions provide you with a menu of best available options.