Tax Process Automation

The Evolution of Tax Data Management: From Fragmented Excel Workbooks to Unified Data Warehouses

Tax professionals often find themselves juggling multiple responsibilities, from regulatory compliance to financial reporting. While...

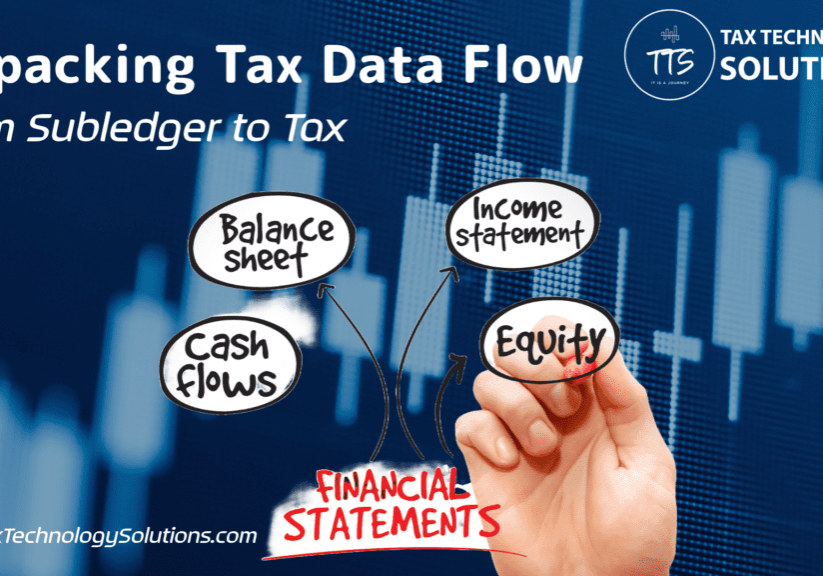

Tax Technology Primer—Understanding Financial Data Flow

The field of Tax Technology involves the integration of technology with tax processes. Tax Technology...

Why Small Tax Technology Firms Are the Smarter Choice for Some Businesses

In today’s fast-paced and ever-evolving financial landscape, businesses face increasing complexity when it comes to...

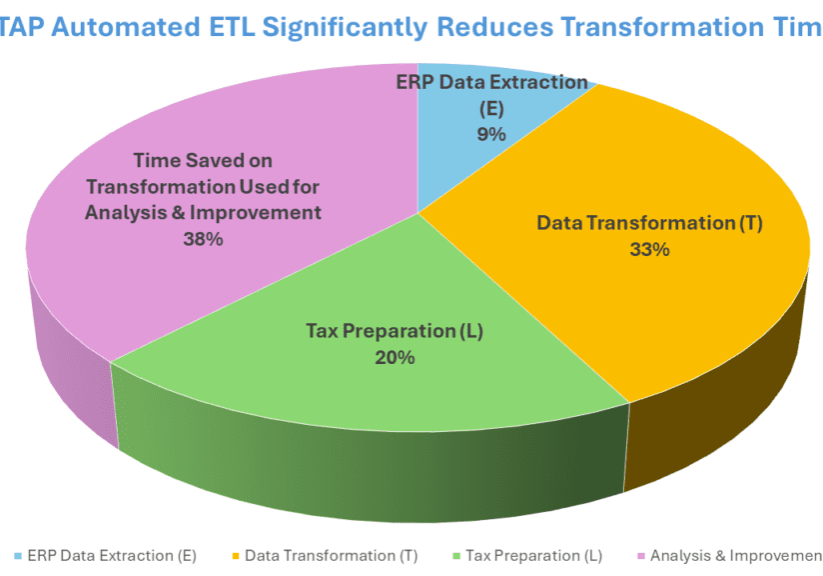

Tax Data Warehouse – The Essential Foundation for Process Automation

A tax data warehouse is a centralized repository that consolidates a company's tax-related data, streamlining...

Tax Process Revolution: The Crucial Role of Technology in Modern Tax Department

In today's rapidly evolving business landscape, companies that adopt technological innovations gain substantial advantages. Deloitte's...

Tax Process Automation: A Strategic Necessity

In the rapidly evolving landscape of corporate finance, tax departments are increasingly finding themselves at...

Why is Corporate Tax Drowning in Manual Excel Reports?

Corporate tax departments frequently encounter numerous obstacles when integrating technology and automation. This is particularly...

Technology Adoption in Tax and Finance—Mostly Talk, Not Much Action

Among those well-acquainted with the Finance industry, it’s widely recognized that some of the most...